The True Bucks Theory: When Do We Really Know What We're Watching?

A study of Milwaukee Bucks game logs since 1976 reveals surprising patterns about when NBA teams show their true identity

Every NBA season starts the same way. We watch the first few games, overreact to everything, then inevitably someone wise says "it's still early." But how early is too early to draw conclusions? When do we actually know what kind of team we're watching?

I got curious about this recently while watching the Milwaukee Bucks. Not the scientific curiosity that leads to groundbreaking research, but the kind that makes you dig through 48 years of box scores wondering if there's a pattern to when teams show their true colors.

What emerged was something I'm calling the "True Bucks" metric. It's not exactly analytics department material, but it might tell us something interesting about when NBA teams become themselves.

Let me explain...

Part I: The Question Behind the Metric

There's a moment every NBA season that drives fans a little crazy. Your team starts slow, or hot, or just plain weird, and you find yourself asking: "Is this who we really are?"

For some teams, like the 2023-24 Detroit Pistons, the answer reveals itself painfully early. For others, like this year's Milwaukee Bucks (2-8 at the time of writing), it's more complicated. The talent is there, the wins are... going to come (right?), but something feels off. Not quite right.

This got me thinking about patterns. When do we typically know what kind of team we're actually watching? Not the "it's too early to tell" version, not the "wait until they gel" version, but the real deal. The team that will ultimately define that season.

So I did what any slightly obsessive basketball fan would do – I started digging through Milwaukee Bucks box scores. All of them. Going back to the NBA-ABA merger in 1976. Every game, every season, looking for the moment when the Bucks first showed us who they really were.

Yes, I know. This is probably not how normal people spend their downtime.

But here's the thing about sports statistics: sometimes the simplest questions lead you down the most interesting rabbit holes. What started as basic curiosity about when to start taking early season trends seriously turned into a 48-year investigation of team identity and performance patterns.

What I found was both obvious and surprising. Teams do tend to show their true nature at a fairly predictable point in the season. But not always in the way you'd expect.

Part II: What is "True Bucks"?

Before we dive in, let me be clear: this isn't some groundbreaking analytical framework that's going to revolutionize basketball statistics. It's more like an interesting way to quantify something we all wonder about – when do we actually know what we're watching?

I'm calling it "True Bucks" because, well, I looked at the Bucks, and I was trying to find their true selves. Real creative, I know.

Here's how it works:

First, we look at how a team finished each season (their final win percentage). Then we work backward to find the first point in the season where they started consistently playing at or above that level. Specifically, I chose to define “consistently” as matching or exceeding their season-ending win percentage in three out of four consecutive games – after at least eight games.

Why those specific numbers? I'll be honest: they're somewhat arbitrary. I could have picked two out of three games or four out of five. But after looking at the game logs, three out of four felt like it captured what I was looking for – a strong enough stretch to suggest real performance, not just a lucky couple of games, while allowing for the occasional off night that even great teams have. As for the eight-game minimum, you need some kind of baseline sample size, and ~10% of the season felt right.

This isn't a complex statistical model – it's literally just me going through game logs and finding patterns. No adjustments for coaching changes, no weighting for strength of schedule, no fancy algorithms. Just a simple question: when did teams start playing like their final record showed they were capable of?"

Let's look at the 2017-18 season as an example.

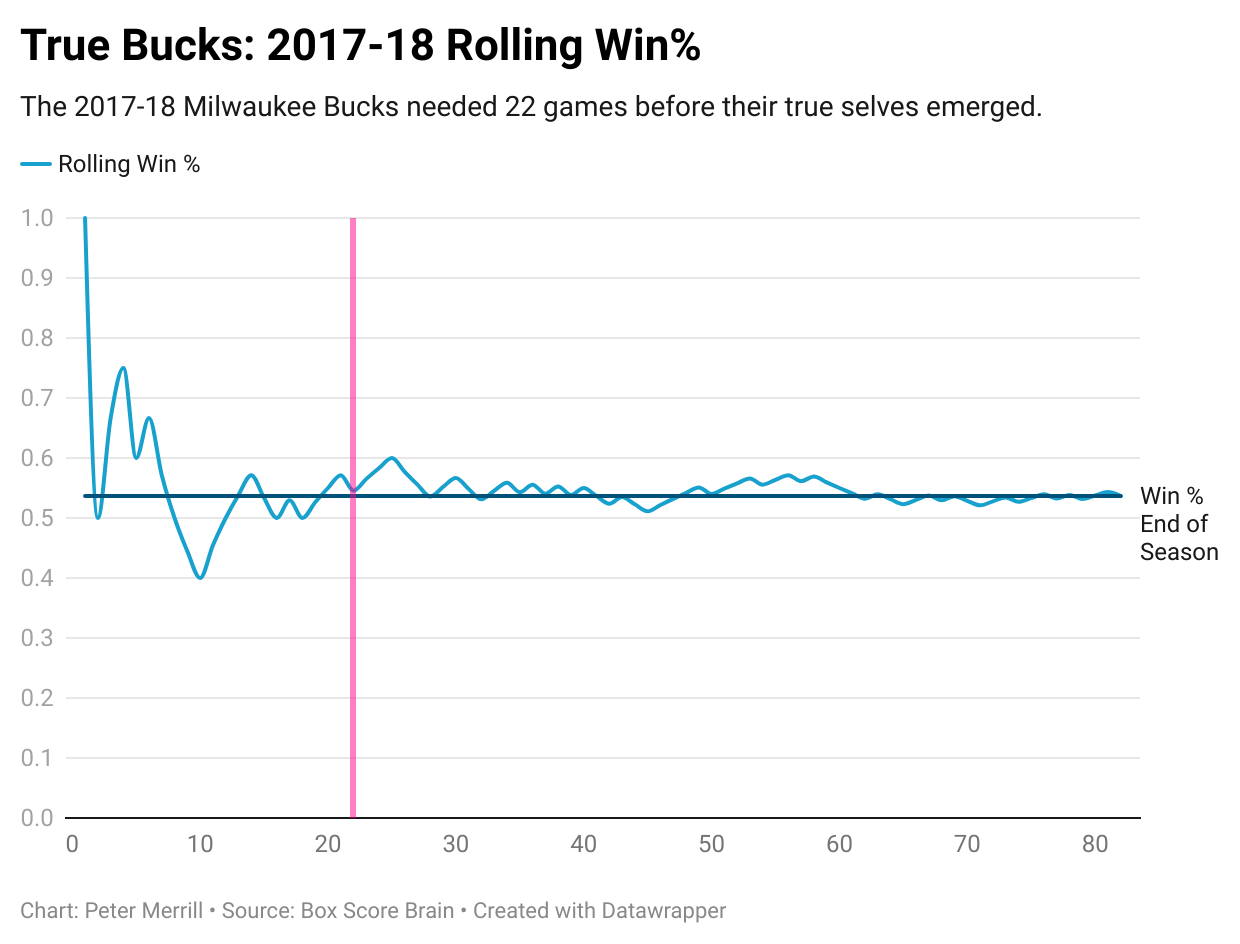

The Bucks finished that year with a .537 winning percentage, but it took 22 games before they hit their "True Bucks" point. Through their first twenty games, they'd hover above and below that level, showing flashes of their potential but lacking consistency. It wasn't until early December that they put together a stretch that truly reflected who they were – a solid but not spectacular team that would finish just above .500. This is exactly the kind of season that makes you wonder: when do we actually know what we're watching?

But not every season is that clear-cut. Sometimes it takes much longer to see the real team emerge. In the 2000-01 season, it took 75 games before the Bucks consistently played at their season-ending level.

This gets at something interesting about NBA teams: some show you exactly who they are right away, while others take months to figure themselves out. The fascinating part isn't just when teams hit their "True Bucks" point – it's what that tells us about the nature of the team itself.

Want to know the really weird part? After looking at 48 seasons of data, some pretty clear patterns emerged. And they might change how you think about when to start taking NBA teams seriously...

Part III: What the Numbers Tell Us

So, what do 48 seasons of Bucks basketball tell us about when teams reveal their true identity? Let's start with the headline numbers:

The median time to reach "True Bucks" status? Just 10 games.

The average? 17.6 games.

That difference between median and average is telling. It means while most teams show their true colors pretty quickly, some serious outliers drag that average up. We're looking at you, 2000-01 Bucks (75 games) and 1978-79 squad (79 games).

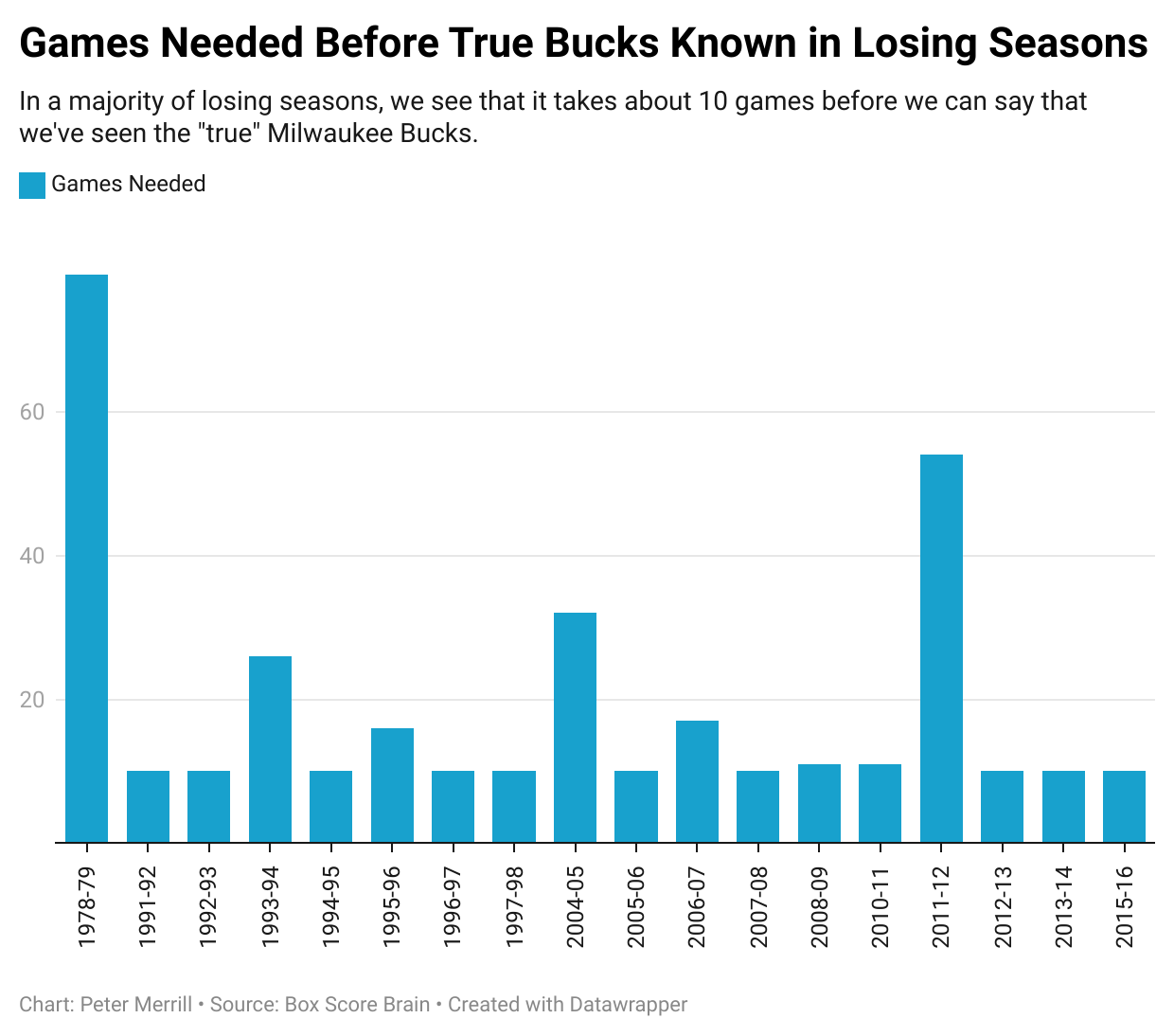

But here's where it gets really interesting: when we separate winning seasons from losing ones, the data tells a surprising story. Looking at losing seasons, we see consistency – most struggling teams show their true identity around the 10-game mark. There's very little variation in this pattern over the decades.

Winning seasons, however, paint a different picture. While many successful Bucks teams also revealed themselves early (like the 2018-19 team that took just 10 games), there's much more variability. Recent successful seasons have actually taken longer to establish team identity. Look at the pattern:

This challenges our intuitive assumptions. We might expect good teams to establish themselves quickly and struggling teams to take time finding their footing. The data suggests almost the opposite – losing teams tend to show their true level consistently early, while winning teams have become increasingly unpredictable in how long they take to establish their identity.

This might reflect the changing nature of the NBA. With more player movement, load management, and sophisticated systems, even good teams might need more time to gel than they used to. But some of the most fascinating insights come from looking at the exceptions to these patterns.

And when it comes to exceptions, the Bucks have some doozies.

Part IV: The Outliers and What They Tell Us

Let's start with the most extreme cases: the 1978-79 Bucks (79 games) and the 2000-01 Bucks (75 games). What makes these seasons particularly interesting is that they represent opposite ends of the success spectrum. The '78-79 team finished below .500, while the '00-01 squad reached the Eastern Conference Finals. Yet both took nearly an entire season to establish their identity.

The 2000-01 case is interesting to me because it breaks our pattern of winning teams becoming more unpredictable in recent years – this was an earlier example of a good team taking its time to find consistency. Led by the "Big Three" of Ray Allen, Glenn Robinson, and Sam Cassell, they would eventually win 52 games and come within one game of the NBA Finals, but their journey there was anything but straightforward.

If you were evaluating that team in January, you probably would have gotten it wrong.

On the flip side, we have seasons like 2018-19, where the Bucks hit their "True Bucks" point just 10 games in. This was Mike Budenholzer's first year as head coach, and conventional wisdom says new coaches need time to implement their systems. Instead, the Bucks immediately played like the 60-win team they would become.

The 2002-03 season presents another interesting case. It took 49 games – well past the halfway point – before the Bucks consistently played at their eventual level. This was a team that hovered around .500 all year (finishing at .512), but the path they took to get there was wildly inconsistent.

Here's something fascinating in the data: when teams take longer than usual to find their identity, their chances of finishing with a winning record gradually decline – but perhaps not as dramatically as you'd expect. Of the 22 seasons where it took more than 10 games to reach their "True Bucks" point, nearly 64% still finished above .500. When we look at teams needing more than 20 games, that success rate drops to about 56%.

The pattern gets more interesting from there. Teams needing more than 30 games saw their winning season probability drop to 40%. But curiously, for teams that took 40 or more games, the ratio stabilizes – exactly half of these late-blooming teams still managed winning records. Even at the extreme end, with teams needing 50+ games, a third still finished above .500.

Small sample size, but this does challenge our assumptions about slow starts.

While taking longer to find your identity generally correlates with a lower chance of success, it's far from a death sentence. The data suggests that even teams still searching for consistency halfway through the season have a reasonable shot at turning things around.

The most recent outlier? The 2021-22 season, where it took 25 games before we saw the "real" Bucks emerge. Coming off their championship, they started relatively slower than expected but eventually rounded into form as a 51-win team. This raises an interesting question about championship hangovers and how they affect early season performance.

These outliers teach us something important about basketball: team chemistry isn't just about talent or coaching – it's about timing. And in the modern NBA, that timing seems to be becoming more unpredictable, at least for winning teams. While struggling teams tend to reveal themselves quickly and consistently, successful teams appear to be taking increasingly varied paths to finding their identity.

Part V: So What Does All This Mean?

Let me be clear about something: the "True Bucks" metric isn't going to revolutionize basketball analytics. It's not going to help teams scout talent or set rotations. It's just an interesting way to look at something every basketball fan wonders about – when can we trust what we're seeing?

That said, 48 years of data tells us some interesting things.

First, that 10-game mark keeps showing up, and it's not arbitrary.

Note: Click here to open that table in a new tab.

The median time for teams to reach their "True Bucks" point is 10 games – about when most coaches say they start to have a feel for their team. But here's the catch: this is much more reliable for good teams than struggling ones. When a team starts strong and stays strong, we can usually trust it. When they struggle early, well, that's when things get complicated.

There are some caveats worth mentioning. This is a straightforward look at game results – it doesn't account for coaching changes, trades, injuries, or strength of schedule. And when we look at those late-blooming teams that turned things around, we're naturally only seeing the ones that succeeded – there might be plenty of teams that showed similar patterns but didn't manage to right the ship. Statistics folks call this survivorship bias. But even with these limitations, the patterns we see are intriguing.

Looking at the current NBA landscape, this has some interesting implications. Take this year's Cleveland Cavaliers, who have come out of the gate looking like world-beaters (11-0 at the time of writing this). History suggests that's probably who they really are. On the flip side, when we look at this year’s Bucks – who have stumbled to a concerning 2-8 start – our data provides an interesting historical perspective. In the 48 seasons since the NBA-ABA merger, the Bucks have finished below .500 nineteen times. Our "True Bucks" metric suggests these struggling teams typically needed around 19 games before revealing their true identity, compared to just 15 games for winning teams. So, while this start is concerning, history tells us we might need another month of basketball before we know if this is truly who these Bucks are.

But perhaps the most interesting finding is about those outlier seasons. We found that while taking longer to find your identity generally correlates with a lower chance of success (teams needing 30+ games have just a 40% chance of finishing above .500), it's far from a death sentence. Even teams that take 40 or more games have a 50-50 shot at turning things around. The path to success isn't always straight.

This raises some interesting questions. Would these patterns hold true across other teams? How might the new in-season tournament affect team development patterns? What other "when do we know?" questions could we explore?

And perhaps most importantly: what does this mean for how we watch basketball? Should we be more patient with struggling teams? Less patient? When do we know if it's time to panic?

The beauty of sports is that even with all our data and analysis, we can never know for sure. But maybe that's the point. Maybe the real value of looking at something like the "True Bucks" metric isn't in finding definitive answers, but in understanding the patterns that might help us ask better questions.

I'd love to hear your thoughts. When do you usually feel you "know" what your team is? Have you noticed similar patterns with other franchises? Let me know in the comments below, or if you're a subscriber, email boxscorebrain@substack.com.

Remember, sometimes the most interesting statistical discoveries aren't the ones that give us certainty, but the ones that help us better understand the uncertainty. And in basketball, like in life, uncertainty is part of what makes it fun.

Stay tuned for the next dive into another statistical oddity from sports history.

For those that are curious, you can explore the full dataset used behind the analysis featured in this post. Just open the spreadsheet.

The idea of knowing the "true" version of a team fascinates me. I tinkered with a look at a different angle on this idea before the 2024 MLB wildcard round: https://thrillshot.substack.com/p/mlb-narrative-bracket-wildcard-edition?r=10qtpx

I tried to (quickly) run through the chunks of the season that showed the defining version of the eventual participants. Your deep dive on one team's history is a great way to explore variations and results.

I wonder how basketball's nature as a strong link sport effects the 10-game mark's significance. How many teams alter their best players or highest usage rates over the course of the last 7/8 of the season? How often does that coincide with a change in end result? (I know you didn't go into transactions here.)